If you are dealing with inheritance in Poland, it is important to understand the basic rules governing succession under Polish law. Whether you are a Polish citizen living abroad, a foreigner inheriting property in Poland, or simply planning your estate, this article will help you navigate key issues.

Who Inherits under Polish Law?

In Poland, inheritance can occur through a will (testamentary succession) or, if there is no will, through the default rules of statutory succession.

According to Polish Civil Code, heirs are generally:

- Spouse and descendants (children, grandchildren)

- Parents, siblings, and their descendants

- More distant relatives if closer ones are not available.

Inheritance by Foreigners

Foreigners can inherit property located in Poland. However, the applicable law may depend on international private law rules, especially the EU Succession Regulation.

Usually, the law of the deceased’s last habitual residence applies, but it is possible to choose the law of one’s nationality in advance by making a proper declaration.

Inheritance Taxes in Poland

Inheritance in Poland is generally subject to inheritance tax (podatek od spadków i darowizn). The amount of tax to be paid may depend on:

- The value of the inherited property

- The degree of relationship between the deceased and the heir

Close family members (spouse, children, parents) can often benefit from significant exemptions, but proper formalities must be completed.

Inheritance Proceedings – What to Expect

There are two main ways to confirm inheritance rights in Poland:

- Court proceedings (declaration of inheritance)

- Notarial deed (certificate of succession)

The notarial way is faster but available only when all heirs agree. Otherwise, a court decision is necessary.

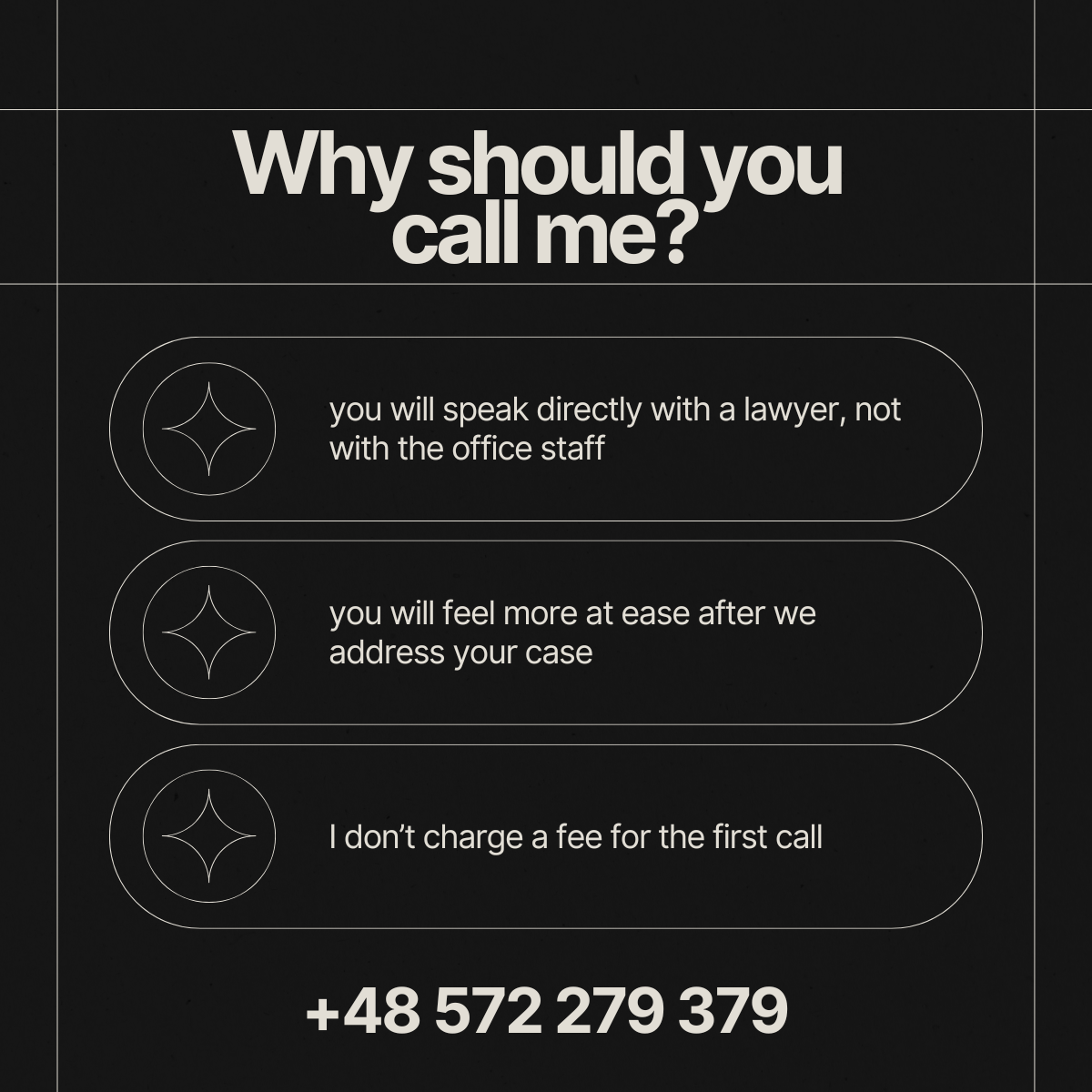

Contact Me For Legal Advice in Poland

This article does not constitute legal advice and should not be relied upon as a basis for making specific decisions. Need legal assistance? Contact me!

At the Law Office of Advocate Paweł J. Mazur, we assist clients with all aspects of inheritance in Poland.

We offer support in:

- Drafting wills and succession plans

- Representing clients in inheritance proceedings before courts and notaries

- Handling cross-border inheritance cases

- Advising on inheritance tax issues

- Securing transfer of inherited real estate and other assets

We provide legal services in Polish, English, German, and Italian. Whether you need help with a simple inheritance matter or a complex cross-border estate, we are here to guide you.

Contact us today to discuss your inheritance case in Poland.

Write to me at: pawel.mazur@pjmazur.pl, call +48 572 279 379 or use the contact form.

Want to learn more? Schedule a free consultation now!

Paweł J. Mazur

Adwokat

Jestem polskim adwokatem.

Ponadto posiadam wpis na listę prawników Anglii i Walii (solicitors). Zobacz więcej